Wed , 21/07/2021, 08:57:25 (GMT+7)

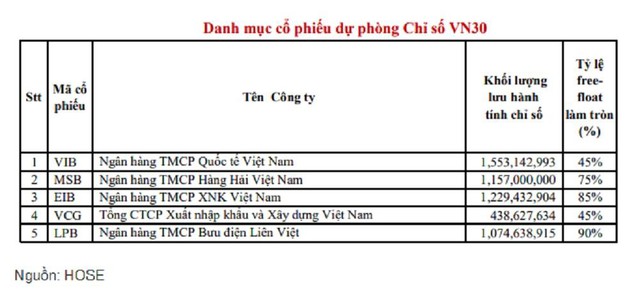

In the list of reserve stocks for VN30 BASKET, VCG, the stock code of Vietnam Construction and Import-Export Company Vinaconex, is the sole name in the non-banking financial group, the remaining 4 names are all banking codes: MSB, LPB, EIB and VIB.

VCG has an outstanding volume of 438.6 million shares, and a free float of 45%, which is the same as banks like VIB.

Since the VN30 basket includes the most-liquid stocks, their prices clearly reflect the supply-demand relationship, minimizing price manipulation, which often happens to stocks with low liquidation.

The VN30 index’s market capitalization is calculated based on the number of free-floating shares, overcoming the disadvantages of the VN-Index by excluding shares restricted from public trading as well as shares held by the state, insiders, and strategic shareholders.

VCG has kept its market price at a competitive level, reaching over VND5x,000 in the past six months. In the correction of the market since the beginning of July until now, VCG is one of the stocks having the lowest correction compared to its peak, sustaining a share price of around VND 44,000. Being able to seek opportunities, actively turning the situation around during the pandemic, building up resources, having the top position in the industry, and competitive ability to make a breakthrough once the pandemic is under control are the pluses for Vinaconex and VCG shares.

The Nghi Son – Dien Chau component project under the North-South Expressway spans 50 kilometers, passing through the two provinces of Thanh Hoa and Nghe An. The project has a total investment of about VND 7,293 under the PPP mode with a 2-year construction period.

It can be seen that the list of key projects that VCG has constructed is getting longer and longer because, from the beginning of the year until now, as an independent contractor and joint venture member, the Corporation has kept winning bids for large value projects such as Package XL03, the NH45 - Nghi Son section under the Eastern North–South Expressway project; the package for main bridge construction of the Vinh Tuy bridge construction investment project phase 2; the package No. 37 XL-05 for construction and installation of the Expanded Ialy Hydropower Plant project, etc.

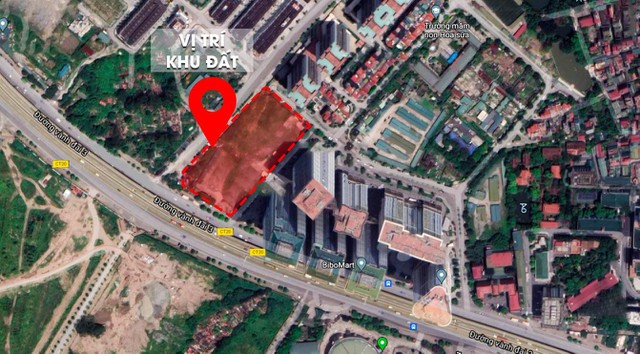

Regarding the real estate field, VCG keeps acquiring more land, with the goal of reaching 5,000 hectares by 2025. In June 2021, VCG was approved by the Hanoi People’s Committee after winning the land use rights auction to carry out the investment construction of the commercial – service, office, and luxury hotel under the Kim Van - Kim Lu new urban area project in Dai Kim ward, Hoang Mai district, Hanoi city. The project’s auction land area was 11,727 sqm, and its construction density was 40%, with 30 floors and 3 basements.

This February, the People’s Committee of Quang Ninh province also issued a decision to recognize the winning result for Vinaconex in the land use rights auction to implement the Urban Residential Area Project at Km3-Km4, Hai Yen ward, Mong Cai city. The auction area is more than 127,662 sqm, used for commercial-service land and social housing, landscaping, etc. The project has been implemented and will be available for sale soon.

VCG has also ramped up investment in the Cat Ba-Amatina tourist urban area project to develop this key resort property. Furthermore, Vinaconex topped out the Green Diamond Complex - 93 Lang Ha on schedule at the end of May and is going to put it on the market to generate revenue.

VCG’s industrial real estate has also prospered since Vinaconex entered the infrastructure leasing contract with two lessees, including Rang Dong Light Source & Vacuum Flask JSC and Q&T Hi-Tech Polymer Co., Ltd. for the High-Tech Industrial Park 2 under Hoa Lac Hi-Tech Park, which is invested for infrastructure development by the Corporation.

Besides the two areas of construction and real estate investment, VCG has currently invested in many sustainable businesses with high-profit margins (in the fields of energy, clean water, education, labor export, etc.), as well as regularly restructured investments flexibly and effectively.

That VCG purchased more than 6.4 million ND2 shares of Northern Electricity Development & Investment JSC No. 2 (NEDI2) at the end of June is considered to be the right move since ND2 is an effective business among current Northern hydropower ones.

Also in the first half of this year, the BOD of VCG approved the policy of acquiring all state shares (41.5%) at Dongthap Building Materials & Construction JSC (BDT).

VCG’s production figures for the second quarter of 2021 have not been released yet, but with the positive news that has been coming in throughout the year, it’s expected that the Corporation’s Q2 financial statements will be filled with many promising signs.

The business strategy focusing on three core areas, the vitality, positivity, and proactiveness in executing strategies are all guarantees of VCG’s future breakthrough.